Betwinner Bangladesh Payments

Betwinner Bangladesh Payments cover all financial operations on the platform, from deposits to withdrawals, with a focus on speed, transparency, and local compatibility. On this page, we explain how payment methods work in Bangladesh, what users can expect in terms of limits, processing time, and fees, and why our system remains stable under real usage conditions. This material is intended for players who want clear rules and predictable transactions when managing their balance.

Our team at Betwinner relies on internal payment statistics, transaction logs, and verified operational tests. We analyze how users in Bangladesh deposit and withdraw funds, which methods they choose most often, and where delays or errors may occur. These data points help us adapt Betwinner payment methods to local banking practices and user behavior. The goal is to provide a payment environment where each transaction follows a clear logic, supports common local options, and works consistently without unnecessary steps or uncertainty.

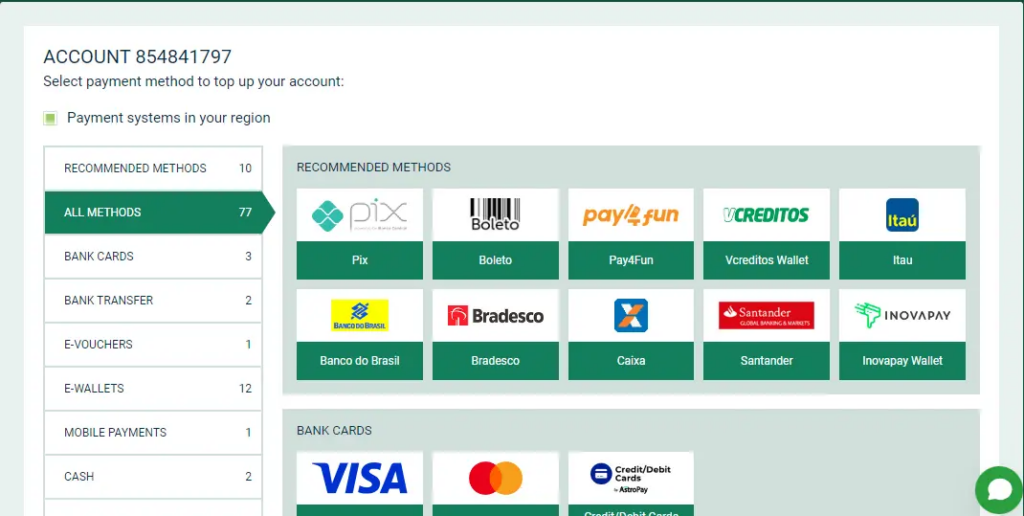

Deposit Methods

We configured deposit methods on Betwinner Bangladesh to support fast balance crediting and predictable limits. Our internal payment data shows that users prefer methods with instant confirmation and clear minimum thresholds. For this reason, we prioritize channels that work reliably with local banking and digital payment infrastructure. All deposits are processed in real time once the payment provider confirms the transaction.

| Deposit Method | Minimum Deposit | Maximum Deposit | Processing Time |

| Local mobile payment services | 300 BDT | Provider-based limits | Instant |

| Bank cards | 500 BDT | Card-specific limits | Instant |

| Digital wallets | 300 BDT | Wallet limits apply | Instant |

In practice, most Betwinner deposit Bangladesh transactions appear in the account balance within seconds. Delays usually occur only when the payment provider requests additional confirmation. Our monitoring shows that verified accounts experience fewer interruptions and higher successful deposit rates.

Common deposit issues we observe include:

- insufficient funds on the selected payment method;

- temporary provider outages;

- incorrect payment details.

Following the on-screen instructions and respecting the Betwinner minimum deposit helps avoid these issues. This structure allows Betwinner deposit methods to remain stable and consistent for users in Bangladesh.

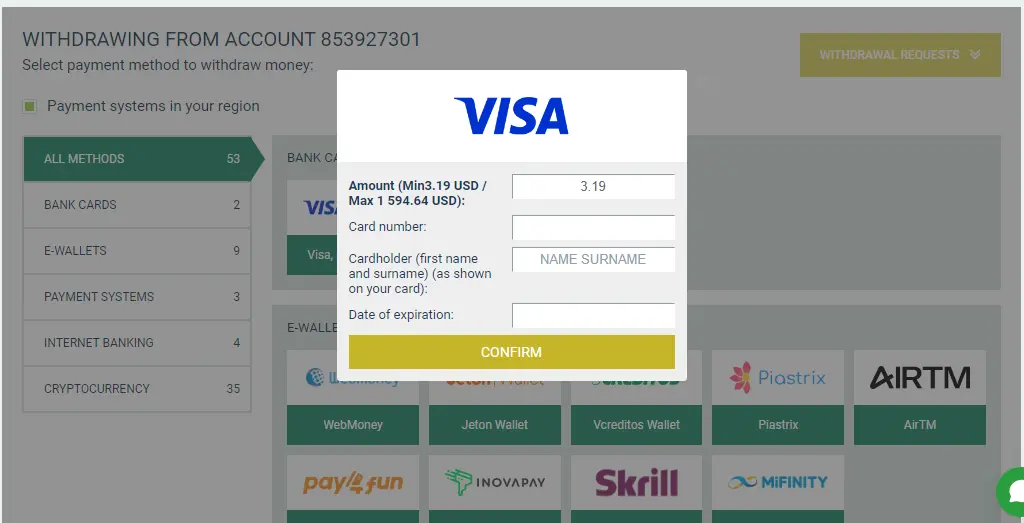

Withdrawal Process

We designed the withdrawal process on Betwinner Bangladesh to be predictable and controlled, with clear limits and processing stages. Our internal payment logs show that users value transparency more than speed alone, so we keep each step visible inside the account. Withdrawals follow a fixed sequence: request, internal review, provider processing, and final crediting.

| Withdrawal Method | Minimum Withdrawal | Maximum Withdrawal | Processing Time |

| Local mobile payment services | 500 BDT | Provider-based limits | Up to 15 minutes after approval |

| Bank cards | 1,000 BDT | Card and bank limits | 1–5 business days |

| Digital wallets | 500 BDT | Wallet limits apply | Up to 24 hours |

In most cases, Betwinner processes withdrawal requests shortly after submission. The final timing depends on the selected method and the payment provider’s own rules. Mobile-based options usually deliver the fastest results, while bank cards require additional bank-side checks.

Before the first withdrawal, the system may request account verification. This step confirms ownership of payment details and protects balances from unauthorized access. Our data shows that once verification is completed, future withdrawals proceed with fewer delays and a higher approval rate.

Fees and Transaction Conditions

We apply a transparent approach to fees and transaction rules on Betwinner Bangladesh. Our internal payment data shows that users prefer clear conditions over hidden charges, so all fee logic remains consistent across supported methods. The system displays applicable terms before confirmation, which allows users to assess the final amount in advance and avoid unexpected balance changes.

Deposit and Withdrawal Fees

In most cases, Betwinner does not charge internal fees for deposits or withdrawals. The credited or withdrawn amount depends mainly on the payment provider’s own policies.

Key points to consider:

- deposits usually arrive without platform fees;

- withdrawals are processed without Betwinner deductions;

- some providers may apply service or network fees outside our control.

Our monitoring indicates that mobile payment services tend to apply lower external fees than bank cards. For this reason, many users choose them for frequent transactions. All fee-related information appears during the transaction process, before final confirmation.

Currency Handling and Conversion Rules

Accounts in Bangladesh operate primarily in BDT. When a user selects a payment method that does not fully match the account currency, the conversion follows predefined rules.

Currency handling principles include:

- conversion based on the current rate set by the payment provider;

- automatic calculation before deposit or withdrawal confirmation;

- no hidden exchange margins applied by Betwinner.

Internal statistics show that users who keep deposits and withdrawals in the same currency experience fewer discrepancies. This consistency helps maintain predictable balances and simplifies transaction tracking across the account.

Payment Security on Betwinner Bangladesh

We built the payment infrastructure on Betwinner Bangladesh to protect user funds at every stage of a transaction. Security measures operate continuously, not only during deposits or withdrawals. Our internal controls focus on preventing unauthorized access, detecting irregular activity, and keeping payment data isolated from external risks. This approach allows transactions to remain stable even during high traffic periods.

Data Protection and Encryption Standards

All payment operations rely on encrypted data exchange between the user’s device, the platform, and the payment provider. Encryption protocols protect sensitive information such as account credentials and transaction details. This security framework underpins Betwinner Bangladesh Payments and applies to every transaction processed on the platform.

Key protection principles include:

- encrypted transmission of payment data;

- restricted access to financial information inside the system;

- separation of user data from operational processes.

Our tests confirm that encrypted channels reduce the risk of interception during transactions on public or mobile networks commonly used in Bangladesh.

Internal Transaction Monitoring

In addition to technical protection, we apply continuous transaction monitoring. Automated systems analyze payment behavior in real time to detect unusual patterns.

Monitoring covers:

- abnormal transaction frequency;

- sudden changes in payment methods;

- repeated failed withdrawal attempts.

When the system flags irregular activity, it may temporarily pause the transaction and request additional confirmation. Internal statistics show that this monitoring prevents the majority of unauthorized attempts before they affect account balances.

FAQ

Betwinner Bangladesh supports payment methods adapted to local usage, including bank cards, digital wallets, and mobile-based payment services. The available options are displayed inside the account and reflect the current configuration for Bangladesh.